In the subject of project valuation, most companies adopt a method that suits their financial and overall economic environment. When valuing a project (or an acquisition), companies need to choose the right parameters for their financial models, consistent with the risks involved and do not behave in the same way. Between choosing the risk-free rate and its periodicity, the cost of debt and equity and the data sources, companies use different valuation methods.

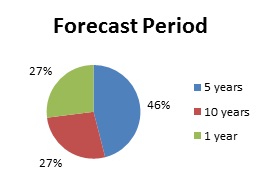

The 2011 survey by the Association for Finance Professionals on the cost of capital (“Current Trends in Estimating and Applying the Cost of Capital”) provides evidence on the project valuation process of 309 companies. The average company evaluates projects using the Discounted Cash Flow model, develops an explicit cash flow forecast for the first five years of the project or investment, and applies an estimated terminal value to all cash flows thereafter.

One of the most surprising facts in this survey is that 84 of the 309 companies surveyed forecast using a one-year horizon, which is inappropriate, as a short projection period will not produce a realistic financial analysis.

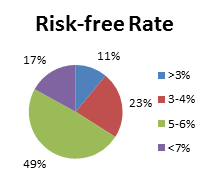

Another surprising fact is that the choice of the risk-free rate that is all but consensual in project valuation. Assuming that all the companies in the survey are based in the US, the risk-free rate used should be the returns on US long-term Government bonds, adjusted by the respective country risk premiums if the company in question has operations outside the country. However, this is not the case.

The choices of the typical company

The survey concludes that, on average, a typical company uses discounted cash flow (DCF) analysis to evaluate the uses of its capital when considering competing projects and long-term investments. When estimating the cash flows to be discounted, the organisations develop an explicit cash flow forecast for the first five years of the project or investment, and applies an estimated terminal value to all cash flows thereafter, using the perpetuity growth model to estimate that terminal value.

Recognising the unpredictability of forecasted cash flows, the typical company uses multiple cash flow scenarios, including best case, expected case, and worst case forecasts. To find the rate at which to discount cash flows, the typical organisation calculates its weighted average cost of capital (WACC) and reviews that calculation only when needed for a valuation.

Furthermore, the companies surveyed do not usually adjust the WACC to reflect factors unique to the project or investment being considered. Those companies recognise that the estimate of WACC is not perfect, but believe it to be accurate within a range of plus or minus 75 basis points. When valuing a potential acquisition, these companies use the estimated cost of capital from a group of companies comparable to the potential acquisition target.

To determine the weights to apply to the cost of debt and the cost of equity in determining the WACC, the typical organisation uses the current book debt-to-equity ratio. The nominal cost of debt is based on the current interest rate on the company’s outstanding debt, with the after-tax cost of debt being calculated using the company’s effective tax rate.

The typical company uses the capital asset pricing model (CAPM) to calculate their cost of equity. To perform that calculation, it uses the current rate on the 10-year Treasury note as risk-free rate. Regardless of where that rate is, the typical company does not impose any floor or cap on the risk-free rate.

The following are some charts that summarise the most relevant valuation assumptions used to produce valuation estimates, according to the survey:

[Updated December 2012 by Hugo Mendes Domingos]